Hello friends,

I got a lot of good feedback from my last post about how people spend with a mentality of hyper-consumption during the holidays. How’s your Christmas shopping going? Haha. A little holiday cheer for you:

In my current FF1 cohort, we’re having a lot of discussion about the expectations of friends and family: how we might want save money and buy time, but the people around us, indeed the people that we love and we wanted to be loved by, expect us to keep spending. And so we keep working jobs we hate to buy things we don’t need.

Those two things are intimately related.

Most people buy gifts during the holidays. Most people I know find it stressful looking for the perfect gift for everyone in the family, but that’s just the expectation. FF graduate Tania texted me last week:

Appreciated your recent hyper consumption piece! My family is big on gifts as a love language. But my big win this year is that I convinced everyone to do secret Santa, so we each only bring one gift instead of each person bringing 10 to 12 gifts 😅.

My friends Annie and Will said something insightful over for tea last week about the stress of giving and receiving gifts. When you’re young, getting gifts is great, because you don’t have any economic agency. When you’re older, you already have everything you need. At this age, none of us needs anything and when you want something, you’ve usually already gotten it for yourself. So giving and receiving gifts is (1) hard because people have everything they need (2) a colossal waste of time and money and (3) stressful because we fear disappointing loved ones with a shitty gift.

This all sucks. So why do we all do it?

Frugal vs. independent

A truism: the great majority of our financial decisions are based on “what will others think of me.” My favorite personal finance writer, Morgan Housel recently wrote in a post about the necessity of thinking independently in personal finance:

The world tells you – even by a mere whisper – that everyone should want the same things: A big house, a nice car, advanced degrees, credentials, social clubs, etc…I like most of those things. But you have to realize how much of their appeal is an attraction to status, which can be completely different from happiness.

During the holidays, most of us aren’t buying because we like buying things. I suspect that the people we’re buying for didn’t actually want things we buy them. It’s just the culture of extravagance: that if you love someone, you’ll spend money on them.1 I think it made sense to have a day of extravagance when people lived in deprivation most of the year, but that’s no longer the case. It doesn’t work to constantly indulge yourself.

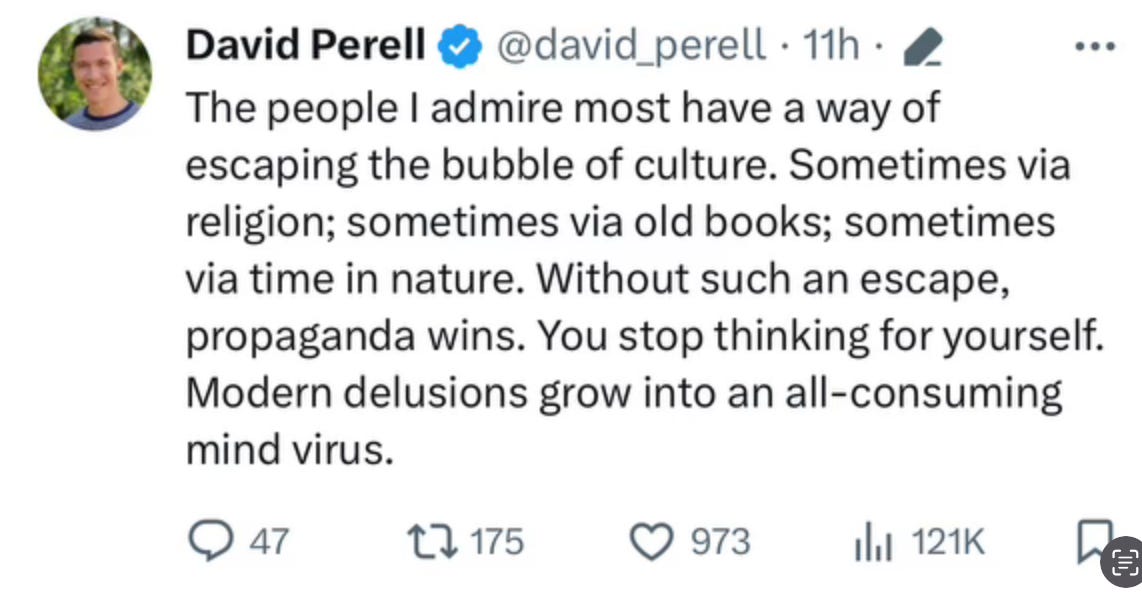

In this culture we're surrounded by messages telling you that that you should spend. But who exactly is telling you that? Anyone who tells you that you should spend is probably benefiting from your consumption. From Instagram influencers to pharmaceutical companies to life coaches, anyone telling you to buy has a personal stake in your consumption.2

So at least some circumspection to these messages is due; they’re dangerous. As any marketer will tell you, the easiest way to sell something to someone is to say, with enough sincerity, that there's something wrong with them. The average American sees about 10,000 ads a day, so ubiquitous that none of us thinks it affects us. But if it didn’t work, corporations wouldn’t do it. We’re swimming in a sea of messages to fix ourselves.

Morgan Housel points out that it doesn’t matter how much how much money you have. The truly financially independent don’t “follow a typical path of what other people told them to like or how to live.”

You know everything already

The wise in all ages have always said the same thing, and the fools, who at all times form the immense majority, have in their way, too, acted alike, and done just the opposite.—Arthur Schopenhauer

Personal finance isn’t novel or complex. The wise in all ages have always done the same things: saved and invested. Lived below their means. Known what is enough.

Fools, who form the immense majority, have always done just the opposite. As I wrote about last week, 96% of shoppers expect to overspend this season. Half of them plan to take on more debt to pay for holiday expenses.

This is not rocket science. At the same time, it’s not easy.

You have to fight against culture.

A demoralized society

The average person doesn’t want to be free. He want to be safe. - H. L. Mencken

Last year I wrote about how most people will nod and agree that our culture of hyper consumption is wasteful and is the primary fuel for climate change. But when asked about personal responsibility, most people’s eyes glaze over, and they will throw up their hands and say, “Yeah, but my individual consumption doesn’t matter.” You see, Douglas, it’s the system that’s the problem, not me. The system, Douglas!

In that essay, I brought up the great Soviet-era Czech dissent, Vaclav Havel who, at great personal risk, wrote about the moral crisis we face today:

“The profound crisis of human identity brought on by living within a lie appears as a deep moral crisis in society. A person who has been seduced by the consumer value system who has no roots in the order of being, no sense of responsibility for anything higher than his or her own personal survival, is a demoralized person. The system depends on this demoralization.”

Is it not true that the far reaching adaptability to living a lie and the effortless spread of social auto-totality have some connection with the general unwillingness of consumption-oriented people to sacrifice some material certainties for the sake of their own spiritual and moral integrity? With their willingness to surrender higher values when faced with the trivializing temptations of modern civilization? With their vulnerability to the attractions of mass indifference?

The system relies on you being demoralized. The system depends on you being de-moralized. It relies on your acquiescence, your believing your choices don’t matter anymore. To stop being moral, to sink into comfort-induced numbness. It’s the only way the system runs.

A little history: Vaclav Havel was writing in the era of the Iron Curtain. His dissent to the system carried much higher risks than any of us who refuse to participate in hyper-consumerism. In the same essay, The Power of the Powerless, he argued that the only way forward was a fundamental reorienting to “living in truth,” to refuse to allow the lie to oppress oneself, and to refuse to be part of the lie that oppresses others. By doing so individuals reveal to others that they have power too:

By breaking the rules of the game, he has disrupted the game as such. He has exposed it as a mere game. He has shattered the world of appearances, the fundamental pillar of the system. He has upset the power structure by tearing apart what holds it together. He has demonstrated that living a lie is living a lie. He has broken through the exalted facade of the system and exposed the real, base foundations of power. He has said that the emperor is naked. And because the emperor is in fact naked, something extremely dangerous has happened: … He has enabled everyone to peer behind the curtain. He has shown everyone that it is possible to live within the truth. Living within the lie can constitute the system only if it is universal.

And the truth? The truth is that you weren’t meant to spend your life attending meetings and spending money. You were meant for something much greater, something simultaneously more terrifying and satisfying. Jungian therapist James Hollis said the two great challenges to living the truth is (1) fear (this is too much for you) and (2) lethargy (the desire to go back to sleep). But the energy of the hero’s journey is to take on this task of living truthfully, finding your dharma. And getting right with your money is an unavoidable part of that.

The great lie we live in is that material things can satisfy our spiritual and moral longings. It’s the message of the marketer, the cheap and easy deceit of the advertiser. Anyone who tells you that you should spend is probably benefiting from your consumption. Last week the UN climate change conference president, who strangely also happens to be the CEO of the United Arab Emirates’ state oil company,3 said there is “no science” indicating that a phase-out of fossil fuels is needed to prevent runaway global warming.4 When we agree to live the little lies, we enable society to live the bigger lie. As the mystics say, how we do one thing is how we do everything.

The great majority of our financial decisions are based on “what will others think of me.” The problem is a shallow, consumerist culture. The only solution to culture is culture. If you personally are just going to acquiesce to the existential destructiveness of hyper-consumerism, what’s going to change?

My friend, the Franciscan mystic Richard Rohr, once told me, “I want to love the truth and be true to love, until finally, at last, they become one and the same.” It starts with loving the truth. It starts with our own spiritual and moral integrity. When that happens, we start to understand what Elizabeth Barrett Browning meant when she said:

“Earth’s crammed with heaven, And every common bush afire with God.”

OK, some practical advice

If you can’t simply quit giving gifts for the holidays, how about staying on a budget? An amount that you actually saved up by consuming less at other parts of the year? ;)

Another cohort of Financial Freedom 1 starts in January. If you haven’t taken it, consider it!

Immigrant culture is big on this.

Including Financial Freedom teachers haha

Sixth largest producer of oil in the world.

Before you get too mad at him, all he is doing is believing another great lie that we all live: the world must change, but not ourselves.

Thank you Douglas. Really liked your "truth" statement of why we are here...we aren't here to spend or make money as our purpose.

It, of course, sounds so obvious when we read it or say it, but our actions (myself included) seem to reveal that much of our focus is indeed on money (the pursuit of it and spending of it).