My friend Allison took FF1 and promptly got a new job, one that took her salary from $55k to $75k a year. She was telling me yesterday how much happier she is in the new company too; FF compelled her to make changes in her life that she had been dragging on.

I get to hear many stories about FF graduates who made a life-changing shift and it’s really gratifying. But an interesting question popped into my head on this one: when have I ever made $75k a year? So I pulled out my Social Security earnings to find out. I made $75k a year twice in my life.1 Super interesting stuff! You should find out your own lifetime earnings too: https://www.ssa.gov/myaccount/

Here are my numbers:

Year Taxed Earnings

2021 $7,xxx

2020 $40,xxx

2019 $15,xxx

2018 $18,xxx

2017 $18,xxx

2016 $10,xxx

2015 $0

2014 $79,xxx

2013 $71,xxx

2012 $69,xxx

2011 $63,xxx

2010 $61,xxx

2009 $46,xxx

2008 $25,xxx

2007 $14,xxx

2006 $24,xxx

2005 $37,xxx

2004 $31,xxx

2003 $27,xxx

2002 $6,xxx

2001 $37,xxx

2000 $121,xxx

1999 $26,xxx

1998 $19,xxx

1997 $2,xxx

1996 $10,xxx

1995 $27,xxx

1994 $1,xxx

1993 $0

1992 $0

1991 $0

1990 $1,xxx

Some wild thoughts:

The median American makes $1.7 million, one with a college degree $2.2 million, one with a professional degree $3.6 million in their lifetime. Since 1995, when I graduated from college, I’ve made $927k in 27 years and don’t plan to make much more. I’m a bad employee. Funny enough, I’ve been laid off 4 times and gotten about $50k from unemployment over the years. Overall, I’ve under-earned the average American by 43%, someone with a college degree by 55% and someone with my degree (J.D.) by 73%.

When I graduated from NYU Law, the average starting salary was $90k. Today, an average NYU Law grad starts at $190k. In 27 years, I have averaged $36k. In fact, I made more than $40k only eight years in my life, more than $75k only twice.2 I’m a bad employee redux.

In those 27 years, I estimate I’ve lived on $25k a year, $675k total. I’m a good saver.3 Yes, I never had kids, so my spending numbers are lower than if I had started a family. But I know plenty of people who don’t have kids who will work their entire lives and still not have enough for retirement because they didn’t control their spending. The overall point of spending well below your income and investing the delta is true for everyone. I’m pretty confident that if I had kids I would have been similarly frugal and taught my kids frugality too.

By being frugal, I had many more career choices. I left being a lawyer to become a Quaker schoolteacher, a community organizer, and a sustainability manager. Being frugal means more freedom while you’re moving towards FIRE.

By investing my $302k of savings ($927k earnings + $50k unemployment - $675k spending), I have over $1 million in net worth. This is the miracle of compound interest. I’m a good investor.

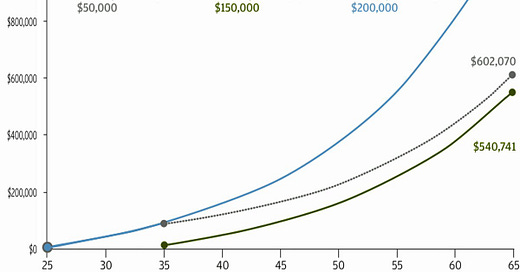

Basically I did this chart from FF1. If I made $36k a year and spent $25k, so I invested $11k a year. When I input $11k a year into a compound interest calculator for 27 years at 8% compounding, I get over $1 million.4 I was a disciplined investor.

Discussion

You’ll notice in 2015, I had zero income. I was 42, recently laid off, and attended a FIRE workshop. There I realized that I already hit financial independence, my passive income had already met my annual expenses. But still I made income post-”retirement” by starting Portland Underground Grad School and working part time for a year at an education nonprofit (before getting laid off again haha). Mr. Money Mustache says work is better when you don’t need the money. It’s true.

$11k per year invested like a non-idiot5 for 22 years equaled my financial freedom. We talk about the miracle of compound interest in FF1 briefly and more in FF2, but I’m realizing now that I may have undersold the power of investing wisely. Almost all my friends earn two to twenty times my average annual income of $36k a year. But I’m really good at turning my annual earnings into annual profit. You can’t really become financially free without turning an annual profit and investing it6. Being a good saver7 and investor allows you to be a bad employee. And eventually a non-employee.

Your personal finance homework

Look up to your lifetime earnings on the Social Security website. It’s interesting to see your earning history all in one place. What comes up for you as you see it?

Do a calculation on what’s your average annual salary and what’s your annual spending. How much does your spending increase with your increases in income on shit you don’t need? Are you investing and taking advantage of the miracle of compound interest?

You can earn a lot of money or a little money, but in the end, it’s your savings rate and how you invest that will get you to financial security. As they say in religion, so many paths to God. Would love your comments below.8

Social Security earnings are a great way to see how you earned from your labor. Social Security doesn’t doesn’t tax investment income, which is taxed through capital gains. It also doesn’t tax unemployment.

Now you see why my parents were so pissed off when I left the law. Sorry, parents!

Note that all of these numbers are nominal, meaning non-inflation adjusted. Adjusting for inflation would make the math more complex, but not more revealing. If you do this exercise, use the Medicare taxed earnings for this calculation. If you make much higher incomes ($200k+ a year?), I don’t think everything is taxed by Social Security, so it might not be accurate? Only a few of you will face the can’t-count-my-lifetime-earnings-through-Social-Security-because-my-income-is-too-high problem.

Index funds.

Unless you create a product that creates a passive income stream that doesn’t rely on your future labor: rental income, royalties, etc.. That’s a WHOLE other topic.

Another reminder of the environmental impact of spending. Your spending is directly correlated to your carbon footprint. There are real ethical and spiritual implications to spending.

Most of you email or text me, which I love. But if you leave a comment, it’ll be like being back in FF1 where people can read each other’s stuff and learn.

I just looked up my earnings for the first time...it's really fascinating. I have these memories of years when things were really tight and about a time when I took a leap of faith quitting one job to take another for half the pay, but seeing it in numbers is really wild what I made work. In that switch I actually went from $44,000 to $14,000 with that job peaking at $27,000 after 3 years. The lesson in this I think is that I also had always been frugal, so I had savings which I lived off of for quite some time, but sadly deferred investing during a large chunk of early adulthood.